The increasing uncertainty of the today’s geopolitical landscape is affecting travel and with it the demand for accommodation. SilverDoor, the world’s leading serviced apartment agent, has released its first quarterly market update report for 2024, highlighting the impact of ongoing geopolitical change on the average daily rates (ADR). The results show global accommodation rates falling in most regions.

Change on the horizon

In particular, tensions in the Middle East and upcoming elections for nine European nations, including the UK’s general election and the US presidential election in November, have impacted corporate traveller confidence and the supply chain. Flight restrictions to a number of Middle East destinations and disruption to Red Sea trade shipping routes, following the Israel-Hamas conflict, have meant significant delays and diversions to services with a direct impact on cost.

European elections and CSRD

Across Europe, four nations – UK, Portugal, Austria and Lithuania – are expected to see general elections delivering a significant change in governing policies. A key part of this will be the roll-out of the EU’s Corporate Sustainability Reporting Directive (CSRD) which has already begun phasing for EU-incorporated companies. It affects those already subject to the EU’s Non-Financial Reporting Directive (NFRD) with other EU companies and non-EU companies, and is likely to impact the policies of any new government. In the US, the upcoming presidential election is also expected to impact both pricing and availability as rallies and conventions get underway.

Global accommodation rates falling

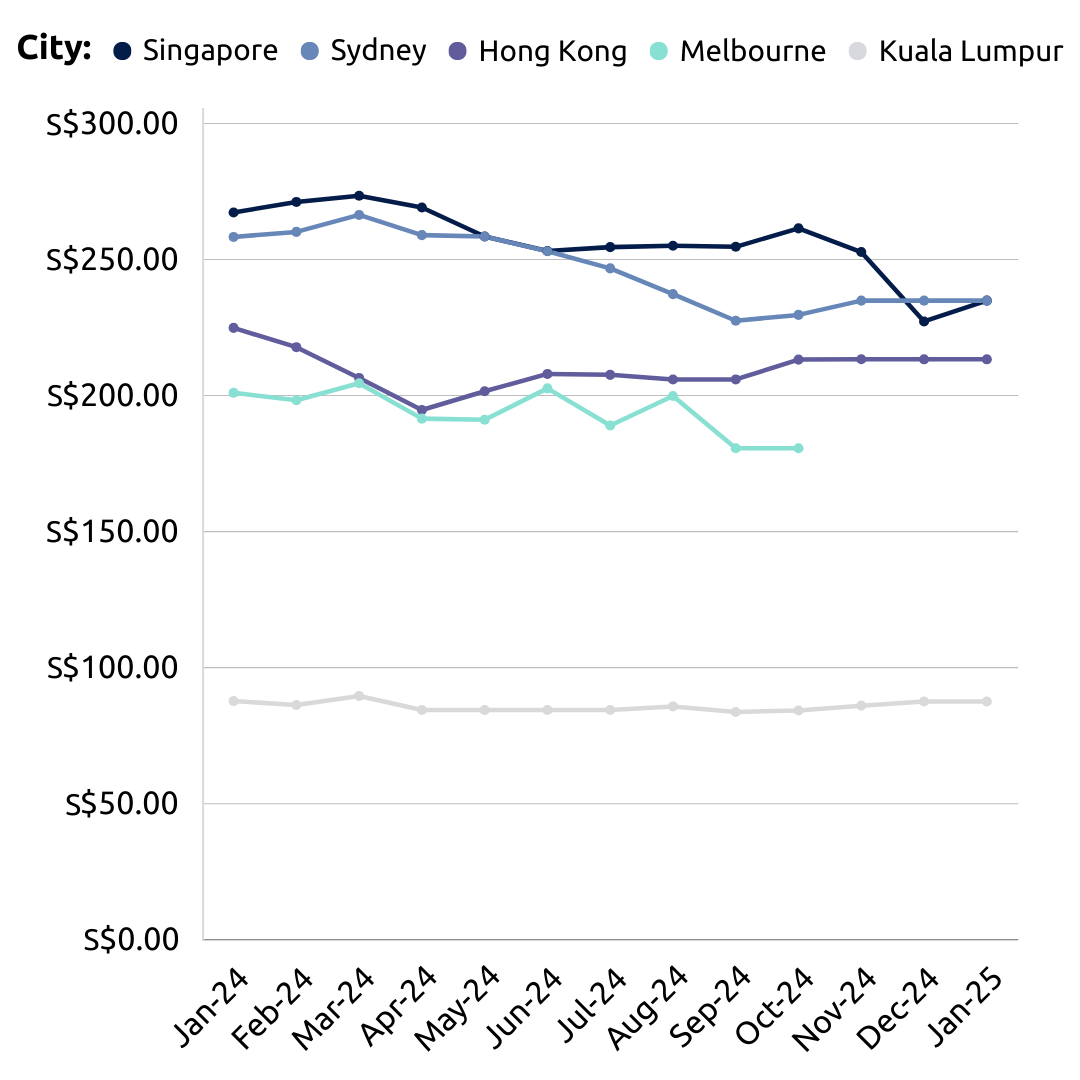

From a serviced apartment perspective, globally, ADR has dropped 3% to £157.60 (Nov 23-Jan 24) compared to the same period last year (Nov 22-Jan 23). By region, APAC ADR has seen less of a drop from S$236.38 in Nov 22-Jan 23 to S$231.27 in Nov 23-Jan 24 – a 2.1% YoY reduction.

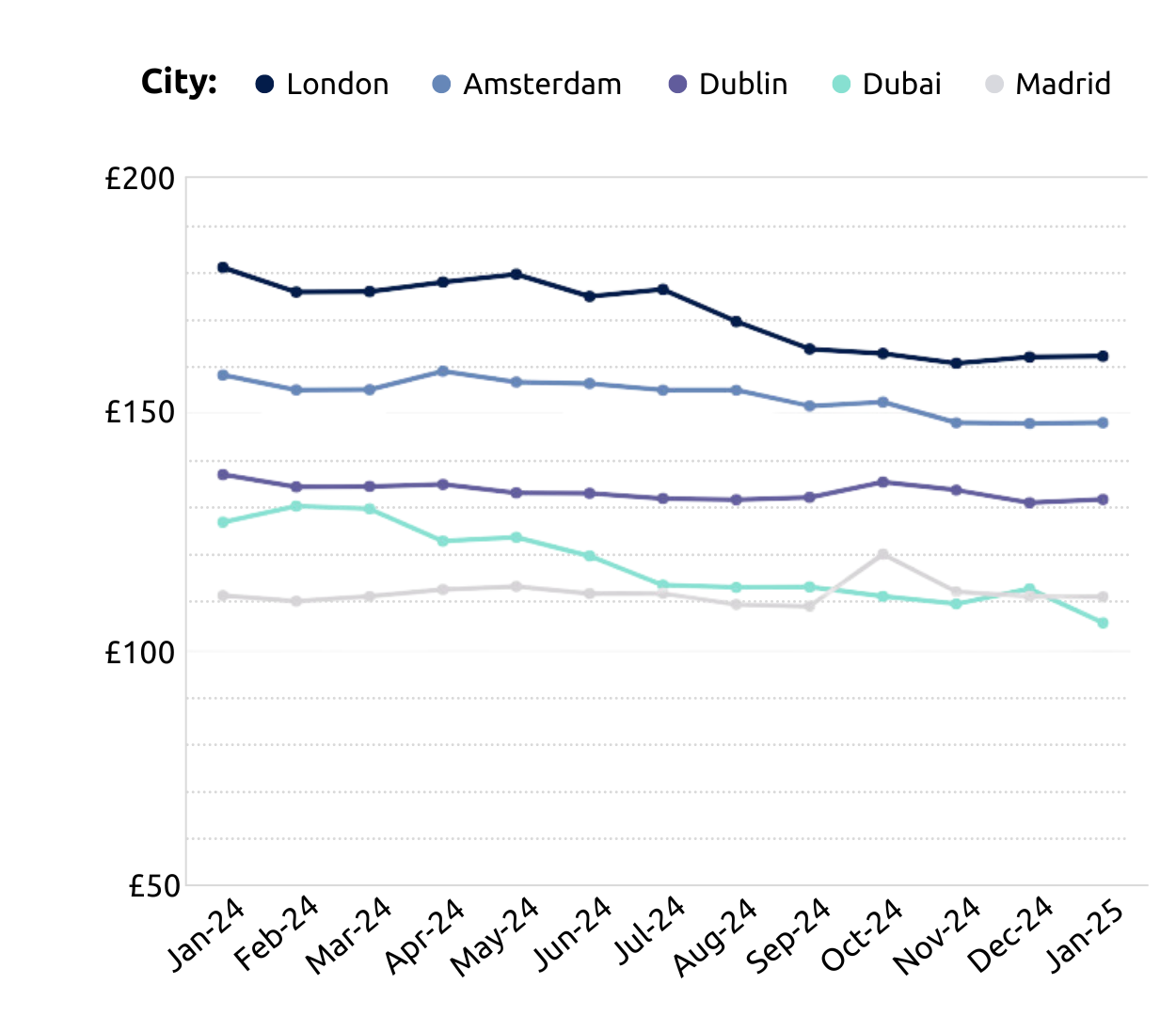

EMEA ADR mirrors the overall global decline and has reduced 3.1% YoY from £165.70/771.37 AED in Nov 22-Jan 23 to £160.40/746.70 AED in Nov 23-Jan 24.

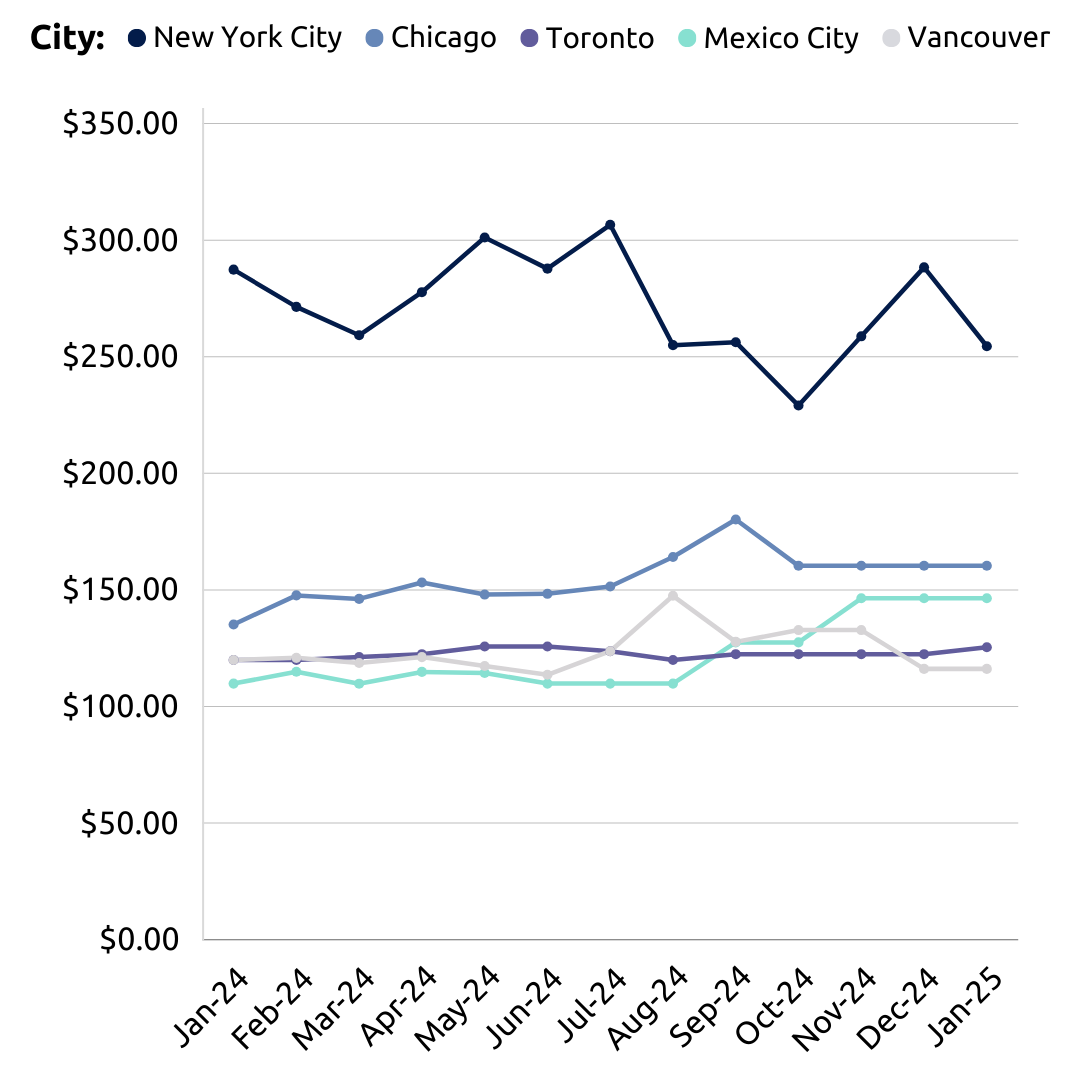

The most significant decline however is in the Americas ADR which has reduced 9.8% YOY, from $221.55 in Nov 22-Jan 23 to $199.75 in Nov 23-Jan 24.

Average length of stay has also seen a reduction of 25% overall across all global markets, indicating a more cautious approach to corporate travel for the turn of year driven by a desire to reduce costs and a hesitancy to travel during a period of marked instability.

There are positive shifts in the Middle East, most notably Dubai, which set new revenue records for the end of 2023. Likewise, diversification in Saudi Arabia is also driving growth as it seeks to shift away from oil as an income source in addition to doubling its female workforce over the past four years. This increase in particular is bearing influence on the type of demand for corporate travel accommodation and working to maintain occupancy levels.

Martin Klima, Chief Customer Officer, SilverDoor comments, “Wider geopolitical events are undeniably impacting business and accommodation – the incoming wave of elections worldwide is likely to have particular implications for the travel market. Whilst there seems to be less rate fluctuation and a reduction of rates in some markets, global instability poses the risk of business uncertainty, less travel confidence and unpredictable market conditions.

“As we head further into the year, it will be interesting to watch how the market shifts in terms of supply and demand as corporate clients maintain a keen eye on cost. Certainly, in the Americas, where we have seen the biggest decline in ADR YOY, corporates are turning their demand away from the more expensive hubs like New York towards more affordable locations.

“In contrast to the uncertainty we’re seeing across much of the Middle East, there is continued investment opportunity in the Emirates and India where demand is high and economic growth remains buoyant. Dubai has maintained strong occupancy levels and accommodation requests for Pune are ever increasing with its growing IT sector.”

The full SilverDoor Market Update is available.

Have you discovered our Recommended Supplier directory of trusted partners yet?