In the growing world of technology, graduates are struggling to find jobs, resulting in brutal competition. Especially for those without work experience or connections. This can over time result in serious graduate debt with an interest rate warning worth paying attention to. Nearly half of students admitting to facing serious barriers when it comes to finding apprenticeships and jobs.

A student writing to the Financial Times discusses how students are neglecting their university work to write cover letters and tailor their CVs. All just for companies to blank their application. This lack of feedback leads to be very stressful and vicious cycle. Sienna Shipton, an undergraduate at the University of Leeds explores why this is happening and what the future holds for current students.

Graduate debt and interest rate warning

Life after university is not a breeze, even after securing a first in your degree. Today’s graduates are struggling to find roles in any field. Sadly as many as 48% of these students end up doing ‘dead end’ and ‘non graduate level’ jobs. Therefore racking up debt, with interest levels rising on top.

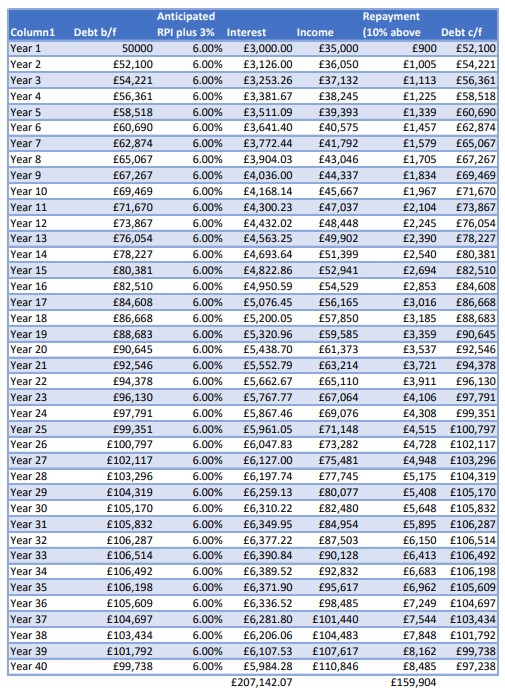

Let’s look at an example:

From December 2023, plan 2 (loan taken out from September 2012 in England or Wales). Meanwhile interest rates scheduled to revert to RPI +3%, this is usually the higher measure of inflation (depending on borrower circumstances). Students come out of their studies, hoping for a bright future, and see thousands added to their loan due to interest which is growing year on year. For some, this results in them working in a role which does not even require a degree. The struggle continues, due to students not actually being certain of what career they want to pursue. This cause uncertainty and also their degree being irrelevant for the job they start to take on.

Interest levels of graduate debt

Interest rates are an important topic to discuss as not all university students believe or understand the amount of debt, due to interest, they will be racking up. Advice from schools in Hertfordshire: “Don’t look at how much you owe, look at how much you pay-back is”. Despite this being valuable advice it’s not being given to students so they would understand what they need to pay back after university. They need to understand the full story of how student debt will grow if they are not regularly paying it off, and the interest too.

The interest on the student loan is 3% over RPI (retail price index, the higher measure of inflation) this is extremely high. They are freezing the threshold on £26,000 of earnings (when payments kick in) wage inflation will make this threshold lower in real terms. For more information, the student finance section on the government website is the best place to start and explains how this works with more helpful stats.

However, the main point to reiterate is that a lot of students do not know what career they want to pursue at age 18, let alone think about debt and interest affecting them 15+ years later.

How does the compound interest affect your student debt?

The chart here is based on a 35k salary and the increase in a student loan debt, due to the power of compound interest.

Based on this chart, Sienna Shipton has calculated the repayments are based on a starting salary of £32k and what the government would then take as repayments will automatically be deducted by employers as income tax and NI is. The government will deduct 10% of earnings above £26k. Of course this cap may be increased over time but it certainly is not scheduled to rise with inflation.

How can we solve this?

The world of work is competitive for graduates, and in fact for all the levels within the job market. It’s not necessarily always a negative thing as a little competition is needed for us to motivate ourselves.

However, to help graduates on to the career ladder, I would like to see more degree apprenticeship opportunities. These could have a much lower wage even, but still be more appealing to students than taking on further debt. Moreover, graduate roles are becoming much harder to find and have increasingly more applicants.

Placement year opportunities and summer internships are also a very useful way to gain experience and improve one’s chances of a job when leaving university. Employers are asking for a degree and also work experience, often gained within their industry.

Further ideas

I’d like to see apprenticeships, industrial placements and summer internships becoming a requirement for students. This would provide vital work experience, maybe even lead to a job, but also help students to work out what they truly have a passion for.

We can’t ignore the importance of connections either. The saying goes: ‘It’s not what you know, it’s who you know’. This really is very unfair for a lot of students and graduates, as not everyone has the connections needed.

How to help young people from all backgrounds build useful connections?

Implementing more degree apprenticeship opportunities is important for this too. These are incredibly competitive, especially as this means the company pays for the degree. More opportunities for these roles, in a wider range of fields are needed for students to gain a better understanding of what they want to do. These degree apprenticeships need more government support due to the price companies have to pay to fund the student’s tuition fees.

Overall, students need to work harder than ever, to not only pay off debt, with increasing interest rates, work out what they want to do, meanwhile actually find a job in this field with the very limited options. Is this too much pressure for students? Are students aware of these obstacles?

For more articles like this, PA Life post regular news updates of current affairs and career related topics.